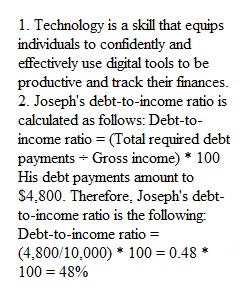

Q 1. Developing __________ skills allows individuals to use various digital tools to efficiently manage and track their finances. 2. Joseph earns $10,000 a month working at a law firm. His monthly living expenses like food and gasoline amount to $3,500. He pays $2,700 for his mortgage. He also has $900 in credit card debt and pays $1,200 toward his auto loan each month. What is Joseph's debt-to-income ratio? 3. Rosalyn works part-time stacking shelves at a supermarket. At the end of each week, she is paid for the hours she has worked that week. The payment that Rosalyn receives is a __________. 4. Which of the following is an advantage of a sole proprietorship? 5. Which of the following is a source of unearned income?

View Related Questions